How to Obtain a Tax Deed or Lien Without Going Through an Auction

Interested in acquiring property through tax deeds or liens without auctions? Bypass the competitive process! OTC purchases let you buy unsold properties directly. Negotiated sales and direct purchase programs also offer non-competitive pathways.

If you’re interested in acquiring property through tax deeds or liens but want to avoid the competitive atmosphere of auctions, you might be wondering if there are alternative methods. The good news is, in some cases, you can bypass the auction process entirely. Here’s a comprehensive guide on how you can potentially secure tax deeds or liens without bidding.

Understanding Tax Deeds and Liens

Before diving into the alternative methods, it's essential to understand the difference between tax deeds and tax liens:

- Tax Deed: When you purchase a tax deed, you are buying the property outright. The local government seizes and sells the property to recoup unpaid property taxes, and you become the new owner.

- Tax Lien: When you purchase a tax lien, you are paying off the property owner's unpaid taxes. In return, you receive the right to collect the owed amount, plus interest, from the property owner. If the owner fails to repay within the redemption period, you might eventually foreclose on the property.

Alternatives to Auctions

Over-the-Counter (OTC) Purchases: In some jurisdictions, properties that do not sell at auction are available for purchase over-the-counter. You can visit the local tax office or courthouse and request a list of these properties. Here’s how to proceed:

- Visit the Tax Office: Contact your local tax assessor’s office or county treasurer’s office to inquire about OTC tax deeds or liens.

- Review the List: Obtain a list of available properties that didn’t sell at auction.

- Select Properties: Choose the properties you are interested in.

- Pay the Taxes: Pay the overdue taxes plus any additional fees to acquire the tax deed or lien.

This method allows you to bypass the competitive bidding process and directly purchase properties or liens. For an example of an OTC purchase process, you can visit Duval County's Tax Certificate Sales Page.

Negotiated Sales: Some counties offer negotiated sales for certain properties. These are properties that may have unique circumstances, such as lower property values or specific legal issues, making them less desirable at auction. Here’s what to do:

- Inquire About Negotiated Sales: Contact the county’s tax office to ask if they conduct negotiated sales.

- Submit an Offer: If available, you can submit an offer for a property.

- Complete Transactions: Purchase properties or liens directly through the program. For an example, you can visit Cook County's Scavenger Sale Information.

Direct Purchase Programs: Certain jurisdictions have programs allowing investors to purchase tax liens or deeds directly. These programs are often designed to reduce the backlog of delinquent properties and streamline the process. Steps include:

- Research Programs: Check if your county or state offers direct purchase programs for tax liens or deeds.

- Apply for the Program: Follow the application process outlined by the program.

- Complete Transactions: Purchase properties or liens directly through the program.

Secondary Market Purchases: You can buy tax liens or deeds from other investors who have already acquired them but are looking to sell. This secondary market allows you to avoid the initial auction process. Here’s how:

- Connect with Investors: Network with investors who are active in the tax lien and deed market.

- Negotiate a Deal: Negotiate the purchase of liens or deeds directly from these investors.

- Transfer Ownership: Complete the necessary legal steps to transfer ownership of the liens or deeds.

Final Thoughts

While auctions are the most common method to acquire tax deeds and liens, they are not the only way. By exploring over-the-counter purchases, negotiated sales, direct purchase programs, and secondary market transactions, you can potentially acquire properties or liens without the competitive bidding process.

Always conduct thorough due diligence before purchasing tax deeds or liens. Understand the local laws and regulations, and consider consulting with a real estate attorney or experienced investor to navigate the process smoothly. With the right approach, you can find lucrative investment opportunities while avoiding the hustle and bustle of auctions.

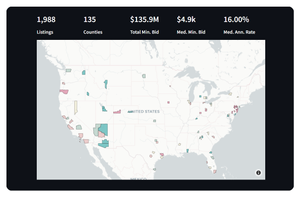

Ready to start your journey in tax lien and deed investing? Our database can help you for various reasons, including tracking delinquent properties, understanding local laws, and maximizing your returns. Visit our database today to get started and take the next step in your investment strategy. Check it out here.