Where are the Big Fish? $6B Property Tax Sale White Paper and Tool

Each year, US counties auction $4 billion to $6 billion of $21B unpaid property taxes to private tax sale investors. Yet, surprisingly, many "big fish" investors have yet to navigate these waters. We ask why and propose a solution, available today.

Each year, US counties (3,000+) auction $4 billion to $6 billion of $21B in unpaid property taxes to private tax sale investors. These tax sale investments can yield up to 36% annually and might even convert to a full ownership interest at a fraction of market value. Yet, surprisingly, many "big fish" – deep-pocketed investors and savvy mega-fund managers – have yet to navigate these waters. We consider why and propose a solution, available today for free and documented below, that addresses the major issues. Finally, we conclude that this uncharted territory presents an asymmetric opportunity for enterprising capital partners to bring institutional scale and discipline to this marketplace.

The reasons for this lack of national market penetration, which our new free tax sale tool aims to solve, include:

- The difficulty of aggregating tax sale auction lists for each county (3,143 counties in the USA)

- Avoid byzantine county websites, we automatically aggregate all tax sale listings, and direct guidance on bidding, into a uniform dataset that you can download into Excel

- The county- and state-level procedural diversity, where each state has its own set of regulations, resulting in varying interest rates, redemption periods, and tax sale types (lien/deed/certificate, etc.)

- Our data includes direct guidance on exactly how to navigate the bidding process for each county, including details such as direct auction links, sale type, auction timing, full Glossary, full data citations to source, etc.

- The fragmented opportunity set and smaller individual deal sizes

- We streamline all county-level data across the US into one standardized tax sale dataset, empowering a programmatic "rinse-and-repeat" approach to tax sale investing for large aggregate fund allocations

- Association with money-making seminars promising outsized returns

- We exclusively share data straight from official county sources, complete with direct links for verification, and focus only on the facts of each deal

The investor who bridges these moats will have a competitive advantage in this oft overlooked market. Our new free tool, available today at the Sapp Capital Data Lab, provides this advantage.

Brief Overview of Tax Sale Investing

Tax sale investing provides a return through statutory interest rates (which, depending on jurisdiction, may be competitively bid down). For example, Alabama and Arizona offer rates of 12% and 16%, respectively, each with a 3-year redemption period. Illinois, with a higher interest rate cap of 36% and a shorter 2-year redemption period, offers a more aggressive investment opportunity albeit on a shorter investment horizon. Certain jurisdictions also enable outright ownership of the subject property in the event of a default upon the end of the redemption period, potentially leading to acquisitions at a drastically reduced basis. These unique opportunities by county underscore the need for a deep understanding of local regulations to devise effective investment strategies.

Our tax sale data streamlines your access to these complex and diverse county tax sale markets. We've created a comprehensive tool that cleans, aggregates, and supplements data from the most populous counties across all 50 states. We are growing our tax sale list at an increasing pace each month, prioritizing by population and state.

How to Use the Tax Sale Data Platform

The Tax Sale Dashboard makes it easy to analyze tax sale investment opportunities across the United States, an experience that can be tedious and impenetrable because information is so scattered and diverse. We bring everything you need to know into one place, making it simpler and more cost-effective for you to search for your exact criteria. We provide unrestricted access to county-level data that's traditionally scattered and costly to compile, often buried deep in outdated county websites and legislation. We've tracked how often the data is updated, ensuring you're working with the most current information. Every piece of data is traceable back to its source, offering an extra layer of confidence in your investment decisions.

When you first arrive at the Sapp Capital Lab, you can optionally log in to unlock premium features. However, you do not need to perform this step until you wish to download the supporting data.

Search for and Filter Tax Sale Data

To search our tax sale data, click the "Add filters" button at the top of the Tax Sale Dashboard.

You will be able to filter through the data on any of the columns available in our dataset. If you'd like to include more columns for your search, click "Choose data columns" on the left side and choose your preferred columns.

Data Access and Download

If you are signed in via a premium subscription, you will see a data table with our full database available for download. If you wish to download the data, just click the download button on the top right. If you wish to explore the data in more detail, you can click on the expand button.

Review Search Results

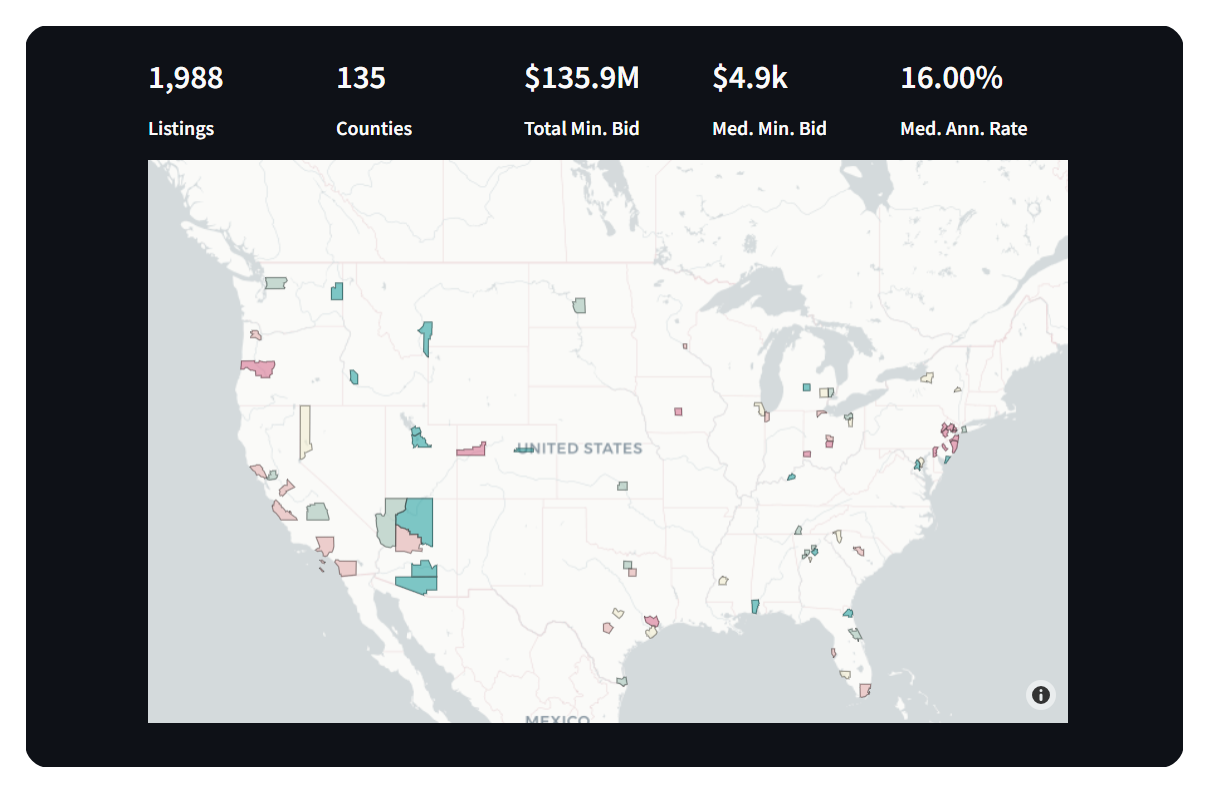

The summary information reflected on the remainder of the page will update to reflect your search criteria. Below is an example of the summary information available for our entire dataset:

We are hard at work filling the gaps in the unstandardized data provided by each county. That said, if you are curious to understand our data availability prior to subscribing, you can scroll to the bottom of the dashboard for an overview. This overview will update to match your specific search criteria, even on the free tier, so you can see whether we have the information you are looking for. This is helpful if you are only interested in a handful of counties.

Conclusion

Looking more into the numbers shows how tax sale investments can pay off. Across the country, these investments can yield statutory returns from 8% to 36% each year, varying by jurisdiction. We track these differences in our database to expedite your entry into this marketplace.

By providing access to a comprehensive, up-to-date database, we empower investors to make informed decisions based on the latest market trends and statutory definitions. Our service is designed not just to simplify access to tax sale listing data but to streamline large-scale capital deployment in this institutionally neglected $6B national market.

The combination of up-to-date market data, strategic insight, and explicit bidding directions for every county makes tax sale investing more accessible and manageable for investors of all levels. Whether you're new to the market or an experienced investor looking to deploy a large capital allocation, our services provide the tools and information necessary to succeed in the competitive landscape of tax sale investing.

Start leveraging the potential of tax sale investing today with our tax sale platform—your gateway to strategic, informed tax sale investment decisions.